top 10

top 10

China Merchants Bank joins top 10 global private wealth managers

China Merchants Bank has broken into the global top ten private wealth managers – ranked by 2017 AUM ($bn) for the first time – according to the latest research by GlobalData, which was presented at the PBI London 2018 conference.

China Merchants Bank has broken into the global top ten private wealth managers – ranked by 2017 AUM ($bn) for the first time – according to the latest research by GlobalData, which was presented at the PBI London 2018 conference.

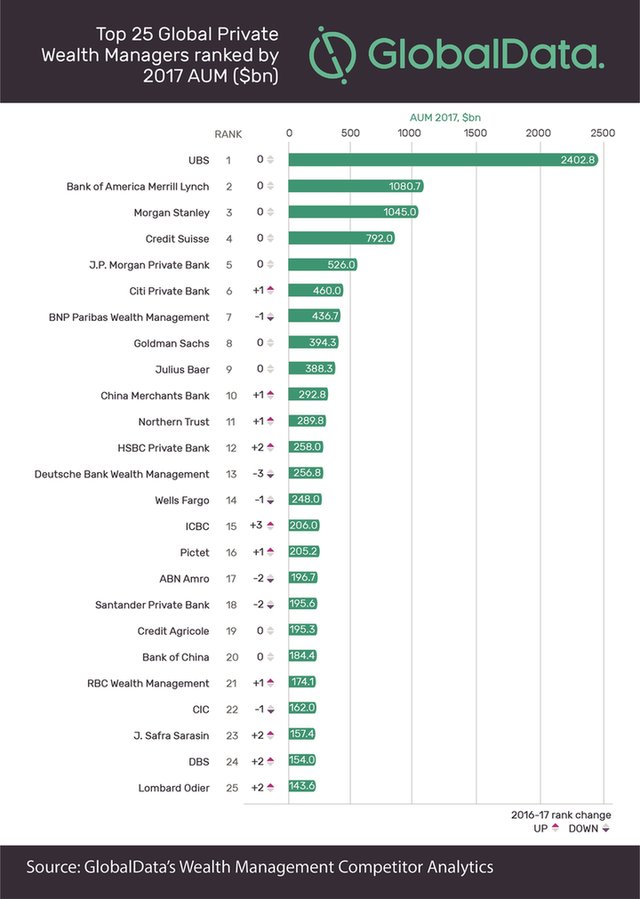

The Chinese bank had assets under management of $292.8bn in 2017 and ranked tenth in GlobalData’s ‘2017 Global Private Wealth Managers AUM Ranking’.

The survey was produced in collaboration with Private Banker International publication (PBI).

The world’s top 25 private wealth managers managed approximately $10.8trn of assets in 2017, 14% higher than 2016.

UBS held number one position in the ‘2017 Global Private Wealth Managers AUM Ranking’, followed by Bank of America Merrill Lynch and Morgan Stanley.

Credit Suisse and J.P. Morgan complete the top five, as all the largest players recorded double digit growth.

Bartosz Golba, GlobalData’s head of wealth management content, said: “On average, the top five competitors increased their assets in 2017 faster than the rest of the players included in the ranking. This is a significant improvement on their 2016 performance, which proved to be a difficult year for the leaders.”

Golba added: “Although the average growth in the lower parts of the ranking might be lower, it is there where competition is the fiercest. The most notable move is China Merchants Bank breaking into the global top 10 for the first time.”

Andrew Haslip, head of financial content for Asia Pacific at GlobalData, said the six Asia Pacific banks tracked: Bank of China, China Merchants Bank, DBS, ICBC, OCBC and Standard Chartered, expanded their AuM by 17.4% in 2017. This is almost 3.5 percentage points higher than the rest of the top wealth managers.

Haslip added: “Almost all international private wealth managers have a focus on developing their presence in Asia Pacific where the market is growing. But it is not an easy market to thrive in with plenty of competition from local players. A lot of this growth is organic and the result of greater wealth across the Asia Pacific region as well as increased uptake of professional management by the HNW individuals of Asia.”