Fintech industry needs tools to select the right data for clients

Data management is the main challenge for the Fintech industry. Technological developments should consider modular and scalable solutions for companies and usable and easy interfaces for clients.

Data are the main resource in the 21st century and for the Fintech industry, but rough data are like rough diamonds: their value is lower than they are sculpted. In finances, technological developers have focused their efforts in providing with solutions to select the right data and show them in a clear and useful manner for investment purposes.

TechRules has identified three main trends in the FinTech branch that will change the current environment. The first one is big data management.

Companies have many ways to know deeply their clients: decision-making, opinions or interests. Every click means information, but millions of clicks have to be managed. Right tools to analyse them will help implement the right solutions.

Secondly, the future is written with the initials API. Companies are aware that they cannot change their platforms every certain time, but productivity can be improved with compatible modular solutions that update features for final clients.

Finally, machine learning and artificial intelligence are the main streams and pillars for the future technological landscape in finances, a field in which TechRules have obtained the best results recently.

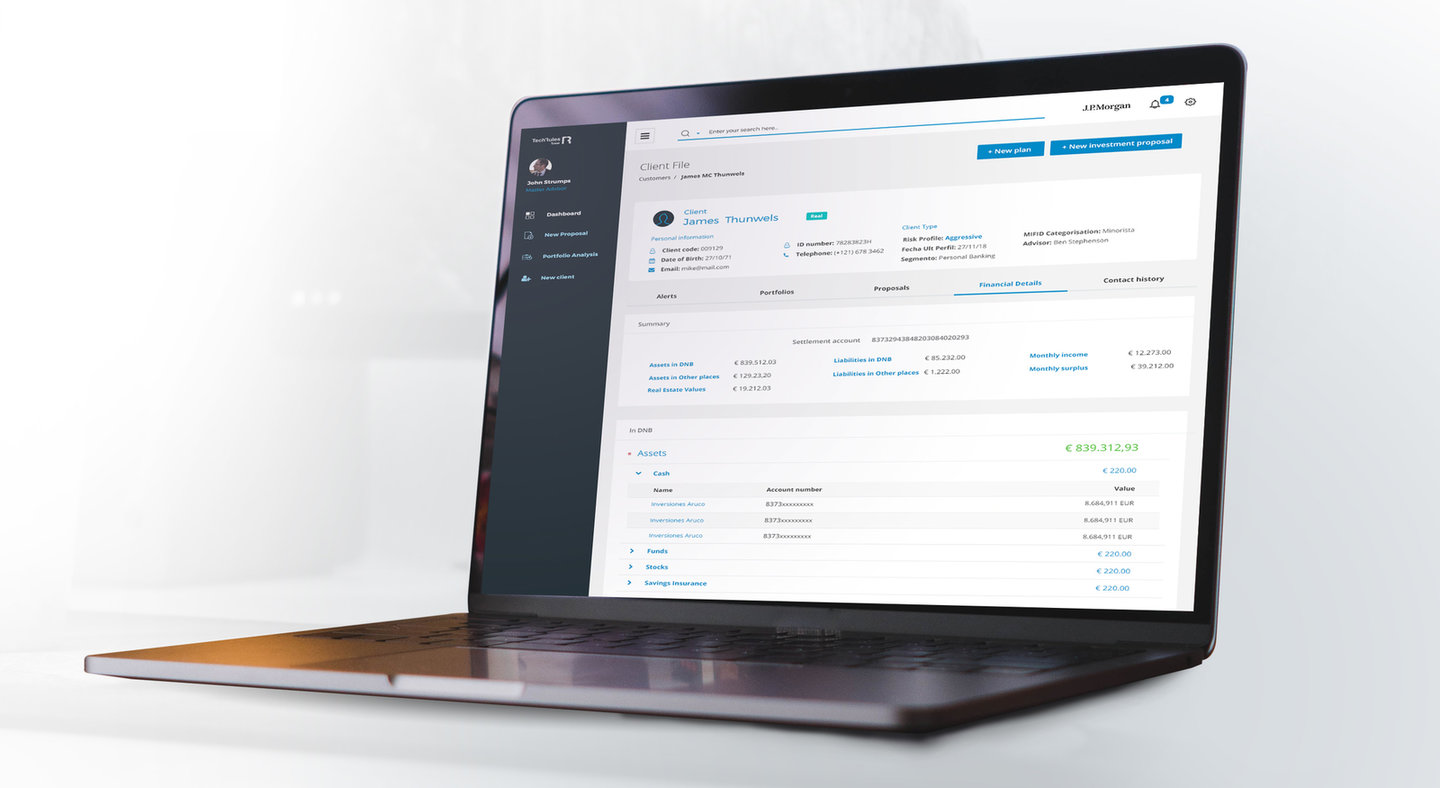

After this analysis of the current situation, TechRules solutions are matching these trends with a product portfolio with a wide range of solutions to better answer sector needs. The main solution is TOWER, the great platform created with a modular scheme, that companies can build depending on their final needs.

This 360º comprehensive solution covers all processes, from investment tasks (model portfolios, several kinds of analytics, rebalancing…) to CRM and customer interfaces.

Robo-Advisors and APIs are another mainline. Robo-Advisors are developed as a high-tech generic brand solution that can be adapted to each company. These investment solutions have been very trendy in the last seven years, but all of them contain the same idea: model portfolios built with different kinds of funds, regular rebalancing and low-cost structure.

These solutions absorbed several million dollars across the world, but in TechRules we provide an adaptable solution with limited investment. On the other hand, APIs are efficient lower cost solutions to solve specific needs for companies. Instead of complex technological developments, APIs are more flexible and compatible with different systems. For clients, APIs are easy-to-use, simple and show attractive interfaces for financial and investment data.

Model portfolio and fund solutions are TechRules’ ideas for specific trendy financial products. Current investors are very influenced by the well-known Modern Portfolio Theory and the concept of the model portfolio is deeply linked to it. Industry need tools to build, analyse and rebalance them connected with the appropriate data sources.

Data final edition is also relevant, as eyes are the first connection between Fintech companies and clients in a screened world. Funds solutions join tradition and modernity, as it shows data from different sources with innovative presentations in more traditional formats.

Certainly, TechRules has discovered that APIs can be the perfect mixture for the three trends: the perfect switch to update large and complex platforms with low investment, a compact result of machine learning and artificial intelligence advances and the way to create new solutions in a similar way as the hardware plug-and-play.

Companies are currently reactive to huge solutions and prefer the flexibility of high-quality modular architectures. Even more, APIs also provide with flexibility not only what technology refers, but also what consumer trends concerns. We can remember several great trends that do not exist anymore, but absorbed large amounts of money. With APIs, there is no question about it: if it does not work for final clients, we can delete it without regretting too much.

TechRules 20 years’ experience plays a relevant role in order to catch new streams in the financial branch. Our history has to do with financial data management, because we have perceived it from the very beginning that they are the current oil and that investors need efficient scalable and flexible solutions to provide with better performances for their final clients.

Our expert team combines deep market knowledge, specialised expertise in technology and common sense to assess the better products in each case.