Thought Leadership

Sponsored by aperture

System selection needs a new business model-based approach

With digital age criteria applied, vendor positions are turned upside down

I

n 2020, wealth management firms spent over $6bn on digitalisation projects. On the surface, this sounds like a good thing: digitalisation translates into lower costs and better services for consumers. The problem is that, in many cases, firms undertook these projects without a clear idea of the ultimate strategic aim. What’s worse, in almost all cases, firms undertook these projects without a reliable view of which software solutions could enable a full digital transformation journey.

This is why we wrote our recent report on “Digital Age Wealth Management” and why we launched The Market Map, our new methodology for evaluating software vendors.

New business models

In its simplest expression, digitalisation flips the industrial age equation. What was scarce in the industrial age was supply; what is scarce in the digital age is demand (attention).

This Realisation has fundamental implications for company strategy and business models. Any business model design discussion must start with the question of how to scalably reach customers (not how to scale supply).

In effect, there are only three (broad) answers. A firm can launch a high quality product focused on a niche market, which it can serve at sufficient scale thanks to internet distribution. A firm can attempt to leverage high engagement and trust to aggregate third-party products and services. Or, lastly, a firm can attempt to aggregate supply, providing its regulated infrastructure and services to be embedded into other customer propositions, effectively leaving the job of acquiring customers to others. There will be variants of each, as shown below, but these three groupings are common to all industries.

The future of aviation is strictly tied to several factors

Technology implications

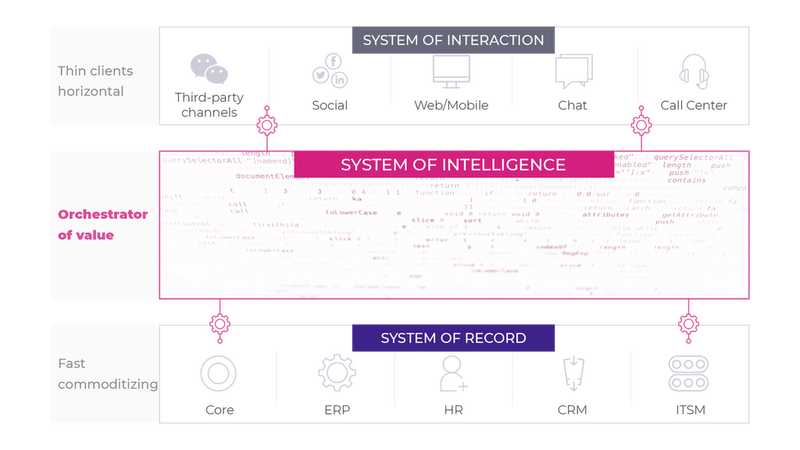

Once we accept that the strategic options open to firms are to aggregate demand, aggregate supply or provide a niche service, then this instructs us on how enterprise IT architecture needs to evolve.

Essentially, what was formerly a tightly coupled architecture has to be decomposed into three main layers.

The first is channels. It is important to separate channels because, in an increasingly networked age, banking services will be distributed through – and ultimately embedded into – many third-party channels.

The second is record-keeping. Record-keeping needs to be separated from the rest of the stack because manufacturing is splitting from distribution. Manufacturing will become more commoditised and will likely be consolidated into a few large platforms. The underlying record-keeping systems will need to be simplified and cloud-deployed in order to operate at the highest scale and lowest cost.

Lastly, orchestration systems are emerging that sit between channels and record-keeping systems. This is true for individual firms to allow them to amalgamate data across record-keeping systems and provide context-relevant services across multiple channels, as well as to allow them to cope with rising interactions and aggregate third-party services. But it is also true across industries in that platforms will emerge that orchestrate the exchange of value between multiple producers on the supply-side and multiple brands on the demand side.

The future of aviation is strictly tied to several factors

The Market Map

Given the extent to which digitalisation is transforming business models and enterprise architecture, it may come as no surprise that traditional software evaluation methodologies have failed to keep up. But, the situation is actually worse than that. Traditional approaches are steering firms towards the wrong choices; systems that can’t enable technology or business model innovation and preclude these firms from capitalizing on the digital shift.

The root cause of the problem is that most evaluation reports continue to score vendors on a combination of functional breadth and vendor maturity. But, as we see it, this approach now suffers from three major flaws:

1. It favors older vendors over newer competitors and larger vendors over smaller ones, when age and size are less and less of a reliable indicator of system quality in the digital age (and are more likely to indicate high technical debt);

2. It places a lot of emphasis on integration, both by favoring functionally rich applications as well as by placing a lot of importance on system integration partners, However in the digital age of everything as a service, broad applications are giving way to best-of-breed components that can be consumed and extended through APIs;

3. There is insufficient weighting given to the non-functional characteristics of solutions. It is critical that a solution can easily interact with other applications in an IT estate, has high scalability and security, and offers low cost of ownership. This massively outweighs the question of whether a solution can meet all of the functional needs of a wealth manager – especially since these functions can be easily sourced from third-parties.

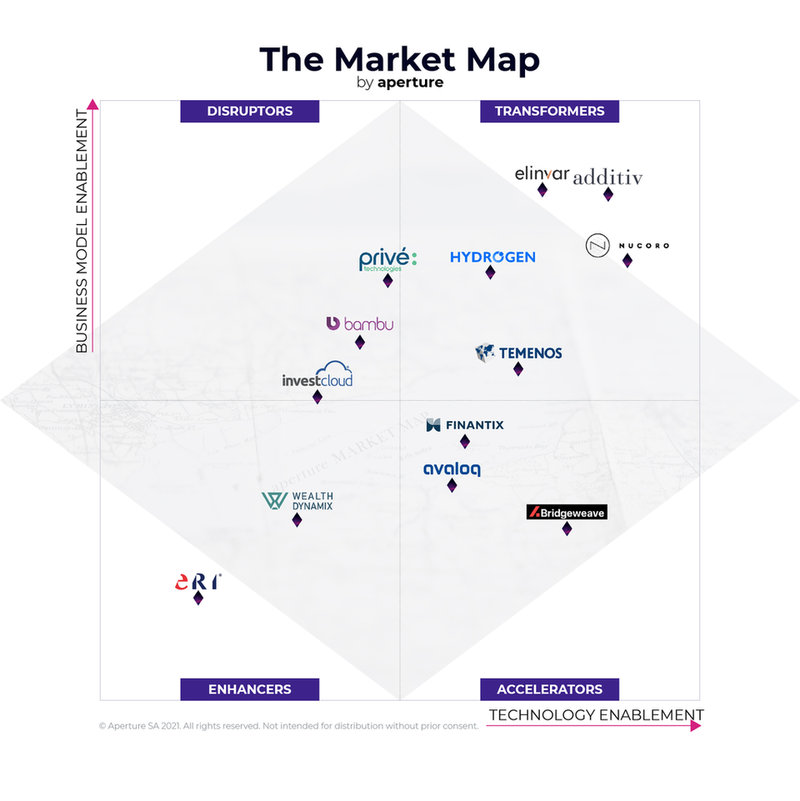

As a result of these shortcomings, we have introduced a new approach, one centered on innovation capabilities. Since non-routine innovation is a function of either technological advancement or business model advancement, or most likely a combination of both, it stands to reason that technology enablement and business model enablement would be more logical criteria to use when assessing systems today.

When we apply these new innovation-centric, digital-age criteria, we see a significant shake-up in the vendor landscape. Former “leaders” become laggards. Former “niche players” become leaders. Not a single vendor is in the same place.

In total, six vendors advance and seven vendors go backwards, underlining not just the difference in scoring criteria, but the extent to which there is a ‘changing of the guard’. The best fit solution to enable the digital transformation of your business is probably one you’ve never heard of – let alone one with 50 offices in 45 countries.

It’s time you used a new map to navigate the changing vendor landscape.

The future of aviation is strictly tied to several factors