Entrepreneurship

regulation

The four faces of today’s entrepreneur: The investments wealthy business-owners are backing

No two entrepreneurs are the same. But a recent report by BNP Paribas Wealth Management and Scorpio Partnership says they can be understood by where they put their wealth. PBI’s Oliver Williams attended the report’s launch.

No two entrepreneurs are the same. But a recent report by BNP Paribas Wealth Management and Scorpio Partnership says they can be understood by where they put their wealth. PBI’s Oliver Williams attended the report’s launch.

Segmentation is a necessary evil. Nobody likes being ‘boxed’. But consumer-facing companies need to draw parallels between people, whether for the sake of marketing or managing their money.

People of a certain age might be grouped together as will those of similar incomes. Marriages and mortgages tend to come at certain times in one’s life and their extravagance determined by earnings.

Wealthy entrepreneurs are still more complex. They not only expect superior service, but their needs are multifaceted. Multiple businesses, loans, outgoings and earnings make managing their money mired in complexity. Even the wealthiest entrepreneurs have a history of bankruptcy as rising cash flow increases complications.

How to segment these most individual of consumers then? BNP Paribas and Scorpio Partnership have attempted this in their latest Entrepreneurs Report. “Our objective is to find how we can better understand elite entrepreneurs,” said Sophia Merlo, co-CEO of BNP Paribas Wealth Management at the report’s launch in November.

The study interviewed 2,763 entrepreneurs with over $10m of investable assets to identify four ‘high conviction investments’. PBI puts them to the test.

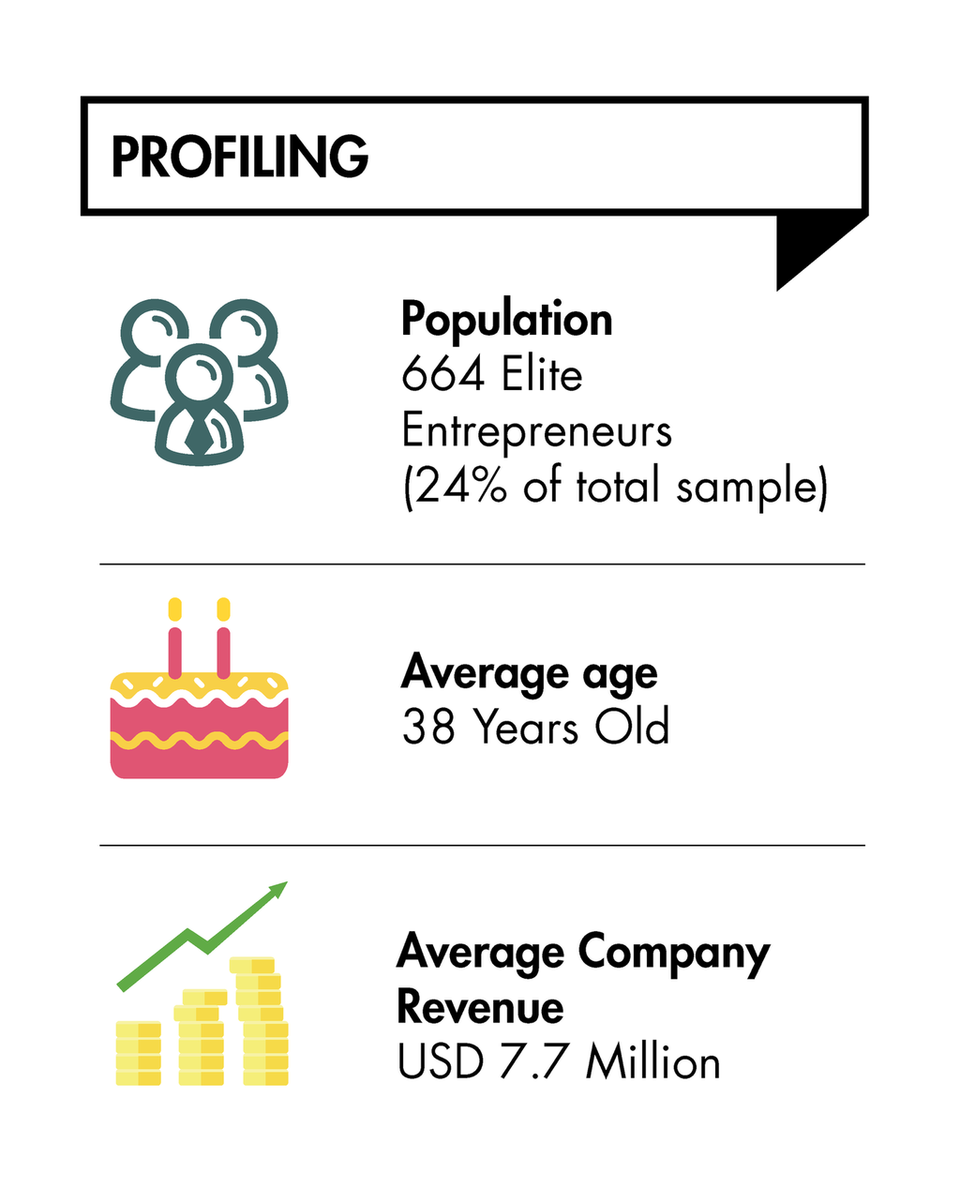

1. Business Angels

Source: BNP Paribas

Funding and mentoring new businesses is not a new thing. But so popular has it become among wealthy individuals that they have a name: ‘business angels’. A third of the entrepreneurs Scorpio Partnership spoke to consider themselves business angels.

Definitions disagree over the difference between a business angel and a venture capitalist, but it is generally agreed that an angel will take more hands-on role in the venture that receives their funding.

“Why do they want to invest? It is about high returns. But equally important to them is they want to invest with innovative companies,” said Tasha Vashisht, senior manager at Scorpio Partnership and one of the report’s authors.

But returns become less important the wealthier somebody is. The same applies to women, says Vashisht: “Mentorship is a strong motivation for them.”

Women are also more likely to support female firms, says the UK Business Angels Association. Around 20% of female angel investors had backed between three and ten women in 2018, while males invest mostly in men.

Jenny Campbell is an entrepreneur who now mentors and funds start-ups across the UK. The British business owner recently joined the TV show, Dragon’s Den, where entrepreneurs pitch their ideas to a panel of business angels.

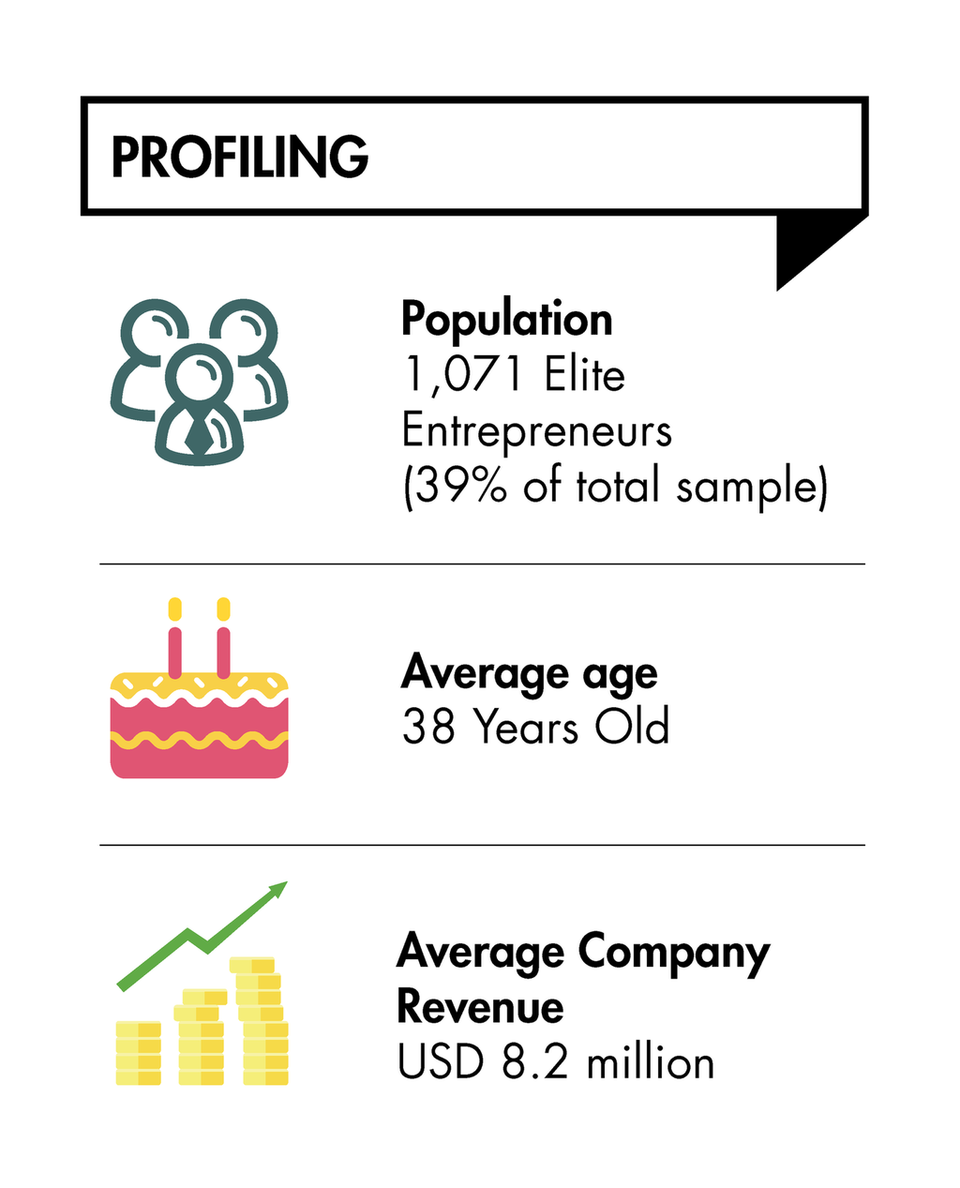

2. Start-up Supporters

Source: BNP Paribas

Similar to business angels, BNP defines a start-up supporter as someone who has made “direct investments into start-ups, companies created less than three years ago”.

This trend is more prevalent in emerging markets. China, Indonesia and India are the top three countries for start-up supporters, according to the Entrepreneur Report. However most are looking at sector specific growth rather than unique business plans: a quarter of entrepreneurs said the ‘growth potential of the sector’ was their most important reason for investing in start-ups.

This trend might yet catch on in developed markets as restrictions on investing in start-ups are lifted. In the US, the SEC said in October it would reduce restrictions on accredited investors – those with a net worth of at least $1m or an annual income of $200,000 for three years.

In the UK, the Enterprise Investment Scheme (EIS) allows tax relief to individual investors who buy shares in a new company. The UK Treasury recently increased that investment limit to £2m.

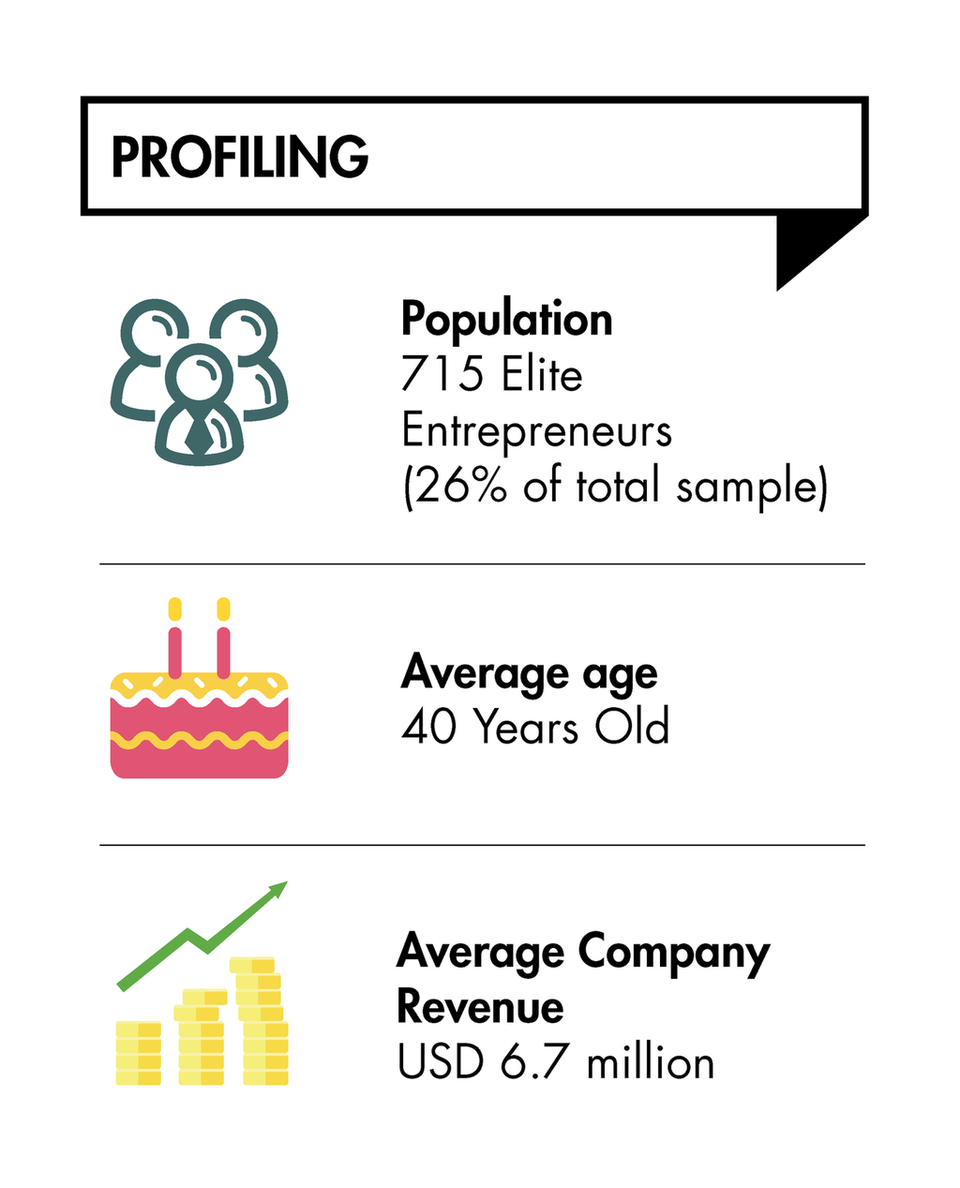

3. Impact Seekers

Source: BNP Paribas

When Scorpio Partnership interviewed entrepreneurs in 2017, “40% considered outcomes of their investment important,” said Vashisht. “Now half are saying that sustainable [outcomes] is their most important success metric.”

One in four impact seekers is aged between 36 and 54, says the Entrepreneurs Report. But the perception that impact investors are young is not always correct, as recent studies have found out.

In a 2018 survey, OppenheimerFunds found that just 14% of millennial investors who cited an interest in sustainable investing actually put their money into the asset class. Another study by UBS found only 39% had a minimum of 1% of their portfolio devoted to sustainable investments.

One of the hindrances for impact seekers is how to measure their effects. There are currently few universally adopted metrics for impact investing. “The industry is working on it,” said Florent Brones, CIO of BNP Paribas Wealth Management. “The analysts are rating the companies. We are rating the asset managers.”

In absence of any formal way to measure impact outcomes, most impact seekers look at ROI. “When we ask them how to measure their success we see that almost 50% look at return on investment as their key success,” says Vashisht.

But is increasing investments to impact funds rather than slowing them, the research found. 37% of entrepreneurs believe sustainable and responsible investments represent the most promising growth potential in the next five years.

“The search for impact is stronger and stronger,” Merlo agreed.

Reduction in the carbon footprint is the second most popular metric used to measure the outcome of impact investing after ROI

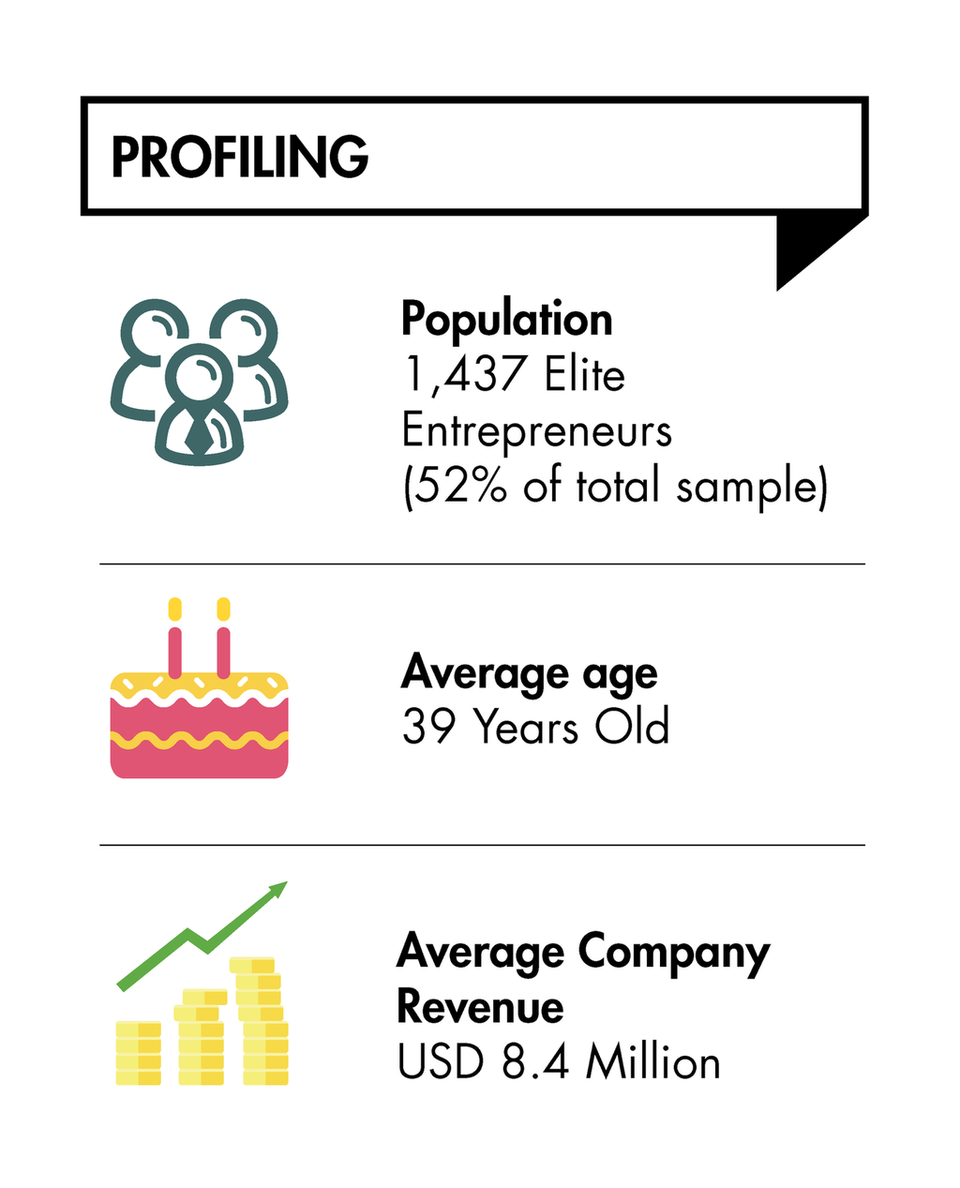

4. Private Equity Investors

Source: BNP Paribas

“High returns are unsurprisingly the biggest motivation here”, said Vashisht. Private equity is often seen as a long-term and uninteresting asset class compared to the others listed here.

However, that does not prevent HNWIs from doing their homework on it. “Entrepreneurs will often do their own supplementary research,” explained Vashisht. “Those at the highest end of the wealth scale are passionate about private equity.”

The wealthiest of private equity investors are also most likely to invest through a family office. Though only 5% of all entrepreneurs interviewed in the Entrepreneurs Report invest through family offices, that appears to be growing.

Family offices dedicate an average of 20% of their portfolio to private equity, according to research by Campden Family Office and UBS. While HNWIs might previously have struggled to compete against institutional investors for a piece of the private equity pie, family offices have made this easier.

Sandaire is a multi-family office that often manages the private equity allocations of smaller single family offices. “We have examples of a couple of single-family office clients where we manage their liquid wealth for them,” James Fleming, Sandaire’s CEO told PBI recently. “We've got a full investment team and we also have a private equity team.”

BNP say they have been “accelerating the opportunity of private equity solutions,” says Vincent Lecomte, co-CEO of BNP Paribas Wealth Management “Investors are looking for double digit returns. This year we aim to raise almost $1bn in PE and real estate funds. There’s really significant pick up”