Open Banking:

You Can’t Avoid It, So You Might as Well Own It!

The opportunities and threats of Open Banking for private banks

If you thought Open Banking was something that affects other people but not you, think again. Open Banking will change the business model of private banks. It’s a great opportunity, but also a huge threat to existing business if you don’t respond promptly and intelligently.

The main opportunities are new scalability options for your own products, new integration possibilities for third-party products, and scope for creating new product types using the data available from Open Banking. The main threat is the possibility of losing the direct bank-client relationship.

If all this sounds daunting, the good news is that Open Banking provides a host of technical possibilities allowing banks to develop novel types of products and play new, profitable roles. Depending on their DNA, their aspirations, and the variety of products they offer, private banks can choose one of four basic strategies or adopt a mix of roles:

- The Integrator

- The Producer

- The Distributor

- The Platform Provider

Four roles private banks can adopt to profitably exploit Open Banking

Each of the four roles relies on a different business model to achieve profitability.

The Integrator is the approach corresponding most closely to the traditional role of banks: offering products to clients using their own client relationship channels and IT infrastructure. The Integrator doesn’t need new revenue sources from Open Banking. Instead, it minimizes external risks by maintaining a maximum amount of control over its applications. If it can maintain its client investment and investment fees by focusing on this niche while making sure its IT operating costs are kept in check, an Integrator will be able to run a profitable wealth management business.

The Producer maximizes the reach of its products by having them distributed by third parties as well. The revenue from these products increases thanks to economies of scale and lower acquisition costs for new customers. A means to achieve this is white-labeling the most successful products and integrating them into the platforms of other banks. Another approach is to offer product APIs (application programming interfaces, the standard connecting “plug” in the Open Banking world) which other banks can easily integrate in their IT platforms.

The Distributor follows the opposite strategy to the Producer’s. Its core strength is offering a user-friendly platform based on modern architecture allowing it to integrate another bank’s products, fintechs, and financial information very quickly. Whereas traditional distribution revenue has been based on contractually agreed trailer fees, revenue in the age of Open Banking will come from platform fees paid by producers and, more importantly, monetizing client data and owning the client relationship. The ideal scenario for a distributor is when clients use the platform for all their financial needs.

Finally, the Platform Provider combines the advantages of offering its own products and distributing innovative client solutions from fintech providers or other banks on a bespoke platform. A private bank as a platform provider will look to become the main bank for its clients as well as for other clients. Most of the wealth will be invested through the platform.

Using the Open Banking Movement as a springboard to long-term profitability

Open Banking is a movement that will go way beyond the requirements of the CMA/PSD2 regulations. Staying still really isn’t an option: you risk being swept away by more innovative providers and new competitors in areas you didn’t even know existed.

The upside is that private banks that take a positive, imaginative approach to the changes can evolve and expand their sources of revenue and ultimately create even stronger relationships with their clients. Imagine a digital platform – owned by you – that incorporates products and services meeting a client’s entire financial and wealth management needs. Some possible ideas:

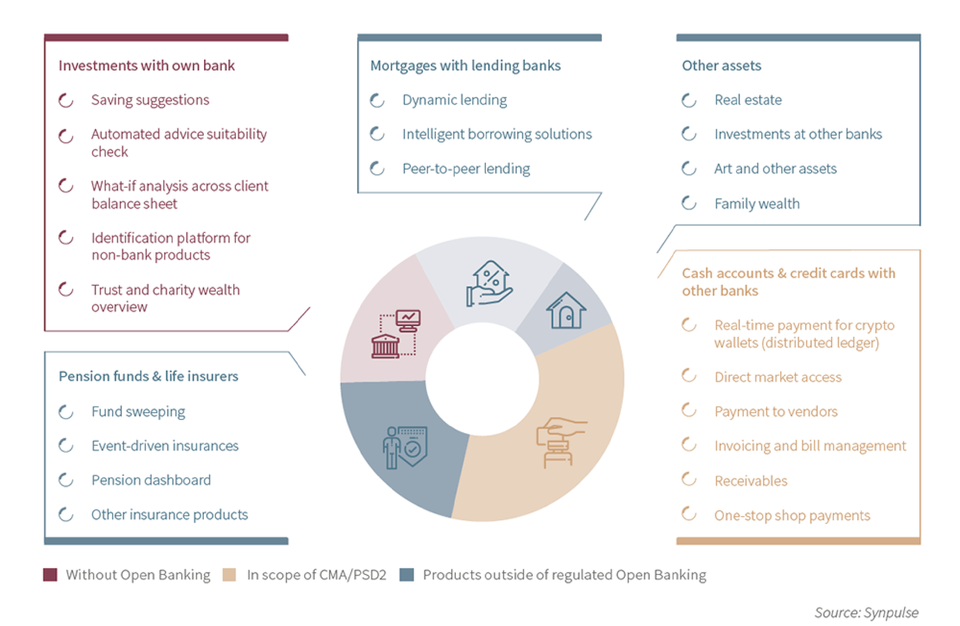

- Multibanking: a service enabling clients to manage their wealth on a single portal (see Fig. 2)

- Automated advice suitability based on all connected positions on the platform

- Dynamic Lombard lending based on bank and external investments

- Cross-selling via direct saving suggestions

- Risk profiling and portfolio monitoring across institutions and borders

- Balance sweeping across the family wealth or managed trusts and businesses

- What-if and scenario simulation through big data modules on the platform

Fig. 1: Multibanking for private clients – full wealth overview and scale of interaction possibilities

This is no pipe dream. Adopt the right strategy and you too could be part of the Open Banking revolution.

Worried? Intrigued? Want to find out more?

We invite you to talk to us or take five minutes to read our article on Open Banking – Strategies for Private Banks.