Thought leadership

Thought leadership

An open digital ecosystem: A Healthcare Illustration for customer-centric digital success

Customer expectations in Wealth Management have changed to align with the same digital convenience afforded to them in other areas of their lives. These customers who have become accustomed the digital experience now have the same expectations for investment advice: speed, accuracy, connectivity and convenience. With these new expectations, Asset & Wealth Management will have to embrace and develop hybrid consulting models which enable customers to personally shape their relationship with their bank,

Customer expectations in Wealth Management have changed to align with the same digital convenience afforded to them in other areas of their lives. These customers who have become accustomed the digital experience now have the same expectations for investment advice: speed, accuracy, connectivity and convenience. With these new expectations, Asset & Wealth Management will have to embrace and develop hybrid consulting models which enable customers to personally shape their relationship with their bank.

The age of the internet and smartphones have brought with them a new way of life in almost every aspect possible. Most recently, the evidence of this change can be found in none other than your GP visit. Traditionally, one would have to go through the process of booking an appointment, waiting (varying between hours and days depending on demand), and then physically travelling either to your doctor’s office or hospital, and once again, waiting to be seen. However; a new age of GP interaction is dawning. Recently, the NHS in the United Kingdom launched a pilot scheme with 3.5 million patients in London, offering a round-the-clock service that allows patients to check their symptoms using a mobile app, and then have a video consultation with a GP within two hours if needed. This ‘GP at Hand’ service is exploiting the benefits a new age of connectivity brings with it. This is only one example of many new Healthcare apps which connect patients directly to the healthcare services they need, on a platform of their choice.

We can all agree that personal Healthcare is an extremely sensitive area for most people; ultimately, we all want the best healthcare service we can access - nevertheless, this has not stopped people from embracing a healthcare technology platform. However; when we examine the similarly sensitive area of Wealth Management, only 27% of 185 Asset & Wealth Management CEOs are open to working with Fintechs.[1]

[1] as documented by a PWC Survey across 45 countries

An outdated model: investment advisers as gatekeepers

Investment Advisors are still regarded as the ultimate experts, just as GPs are; however, patients can now learn about their symptoms and then make a decision on whether to see a GP or not. Savvy-investors can learn about investment products on a digital platform and inform themselves without approaching Investment Advisor until they wish to.

The range of options that investors have for their portfolios are expanding more rapidly than ever before. The task of Wealth Management is to moderate this diversity and make it accessible. This requires platforms for the client experience of the future, as Dirk Klee, Chief Operation Officer at UBS Wealth Management, puts it. Investors expect the same experience as they get from major platforms such as Google and Amazon. What Wealth Management will actually look like in the age of platform economics is only now beginning to emerge. "We all need to learn. It's an open field", says Dirk Klee.

However, digital platforms will not replace investment advisors precisely how a Healthcare App will not replace GPs. Instead, these platforms will combine all possible forms of advice, across a range of channels which may still include face-to-face meetings. Ultimately, the customer, or patient, will have the option to choose the platform that suits their requirements.

Investment Advisors will continue to propose suitable products for an investment strategy, as well as implement the desired investments, and oversee the portfolio - but now they can also offer customers alternatives to time-consuming activities such as meetings during office hours. Individual actions could be carried out digitally and independently, supported by a chat session or robo-advisers if appropriate. In addition, it should be easy for customers to switch between channels, so that they can request a call-back or a personal meeting in just a few clicks without having to enter data that the bank already has.

Another advantage comes in the form of a Wealth Manager being able to monitor the customer's behaviour on the platform, and if it suggests that they need help, this can be offered automatically, further increasing a positive customer experience.

Technology opens up a broad spectrum of possibilities, such as video sequences, a (video) chat, or co-browsing through the investment proposal. In short: the transition between intelligent self-services and personal consulting should be fluid and tailored to the customer.

However; the customer segment addressed in Wealth Management is small, and they have high expectations. How can we enrich the customer journey of modern investors? The answer lies in data analytics and artificial intelligence which afford institutions with key information of their customers and allow a tailored and rich customer experience.

Wealth Management with CREALOGIX

Wealth Management in an open ecosystem

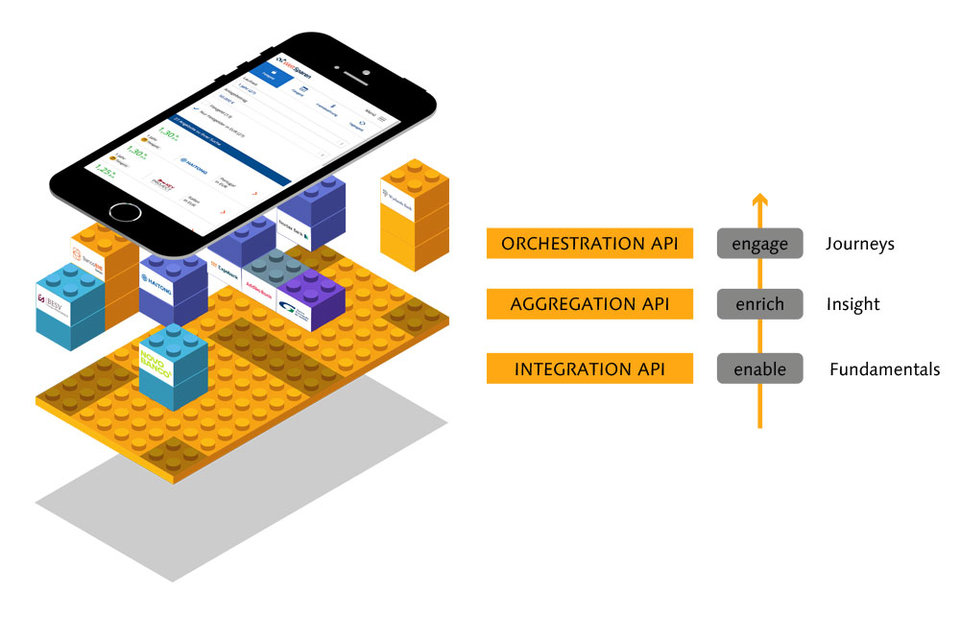

Customer expectations will dictate the future and the challenge to AWM is to master the techniques used by organisations which have already embraced this technology to anticipate and fulfil their customers' needs. As they cannot achieve this exclusively with their own products or with their own technology in isolation, they will need platforms for an open ecosystem that enable them to quickly incorporate new trends into their offerings. The ability to integrate and orchestrate different applications is becoming more important as a success factor – financial institutions can use applications developed in-house along with those from external parties, such as Fintechs or Wealthtechs, to improve the customer experience and retain their wealthy customers in the long term. If they miss this opportunity, others will emerge to take their place – players that the banks currently do not give enough attention to.

In early 2016, David Marcus, Vice President Messaging Products at Facebook, wrote: "It’s so much easier to do everything in one place that has the context of your last interactions, as well as your identity – no need to ever log in – rather than downloading apps that you'll never use again and jumping around from one app to another." Even then, Facebook Messenger already had the "Send & Receive Money" function.

Contact

Maryam Danesh-Kajouri

Global Head of Marketing & Product Marketing

CREALOGIX

+49 711 614 16 -0

Maryam.danesh-kajouri@crealogix.com