Offering technology-led, bespoke services in wealth management

Clients in wealth management – independent of the segment – do have a preference for bespoke services, individually tailored to their needs. However, their willingness to pay for these services varies and is decreasing in most markets.

By additiv AG, Zurich, Thomas Schornstein, Roger Stettler

Meanwhile, the costs of offering a highly customized service through a traditional relationship manager model are going up due to ever increasing regulatory burdens and competition for talent. In parallel we are observing a trend that also in the UHNWI segment, clients are asking for high-quality digital self-services to perform wealth management activities such as investment performance monitoring or cash management.

Customization through technology

While we are convinced that the RM will continue to play an important role in the future to manage the overall client relationship, we think that technology will become an enabler to offer highly customized solutions directly to the client. The automated analysis of structured and unstructured client data allows banks to personalise the offering according to specific client needs.

A digital offering doesn’t mean standardization. In contrary, it is about engaging the client on a personal level and about delivering additional personalised services. Higher revenues based on increased transaction volume of existing and additional services at marginal costs is clearly an optimal place to be in as a bank. Potentially even pricing power might be regained to a certain extent.

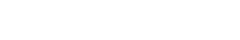

Key benefits of digital offering

A fundamental topic for every wealth manager is the continuous acquisition of new clients. In Private Banking, the average client remains with an institution for a period of about 12 years. Therefore, a bank must replace around 8% of its clients every single year to maintain its asset base in a stagnating stock market environment.

Therefore, it is crucially important to attract new client segments. Especially next generation clients have to be early approached and on-boarded. Most private banks do enforce minimum requirements in terms of wealth size which can be critical within a generational wealth transfer situation.

Win the next generation of clients

Within developed markets such as Europe, wealth management is mainly a business with elderly clients with a median client age of around 60. Until a few years ago, most of these clients haven’t asked for very demanding services and solutions, especially not in the offshore business. Next generation clients have often been neglected, and their requirements have not played an important role in the daily business.

Especially behavioural differences between the generations have not found much attention. While the parents were seeking for highly personal services, their children are focusing more on efficiency, fair pricing and out performance.

However, nowadays existing clients are asking increasingly for attractive digital solutions and services. Expectations from next generation clients are driven by their experiences with online retail digital channels. Digital proficiency such as 24/7 availability anytime, anywhere, speed, ease of use, transparency, and seamless omni-channel offering combined with a fair pricing is a must criterion.

For leading wealth managers, it is imperative to show to the next generation of clients that they can provide these offerings before the wealth is passed on to them. Again, technology is an opportunity. It helps to serve these clients with low marginal costs while offering a highly individualized client experience.

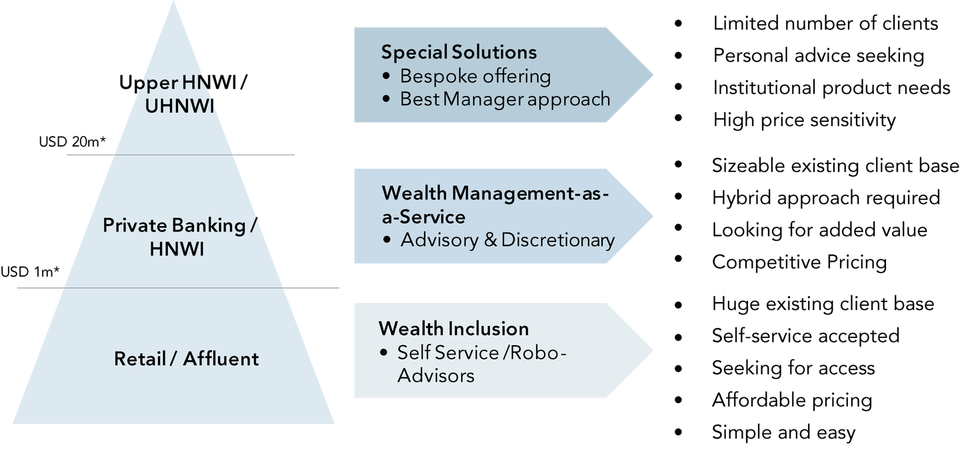

Offering per Client Segment

additiv Digital Finance Suite

– the platform to realize your Finance-as-a-Service ambitions

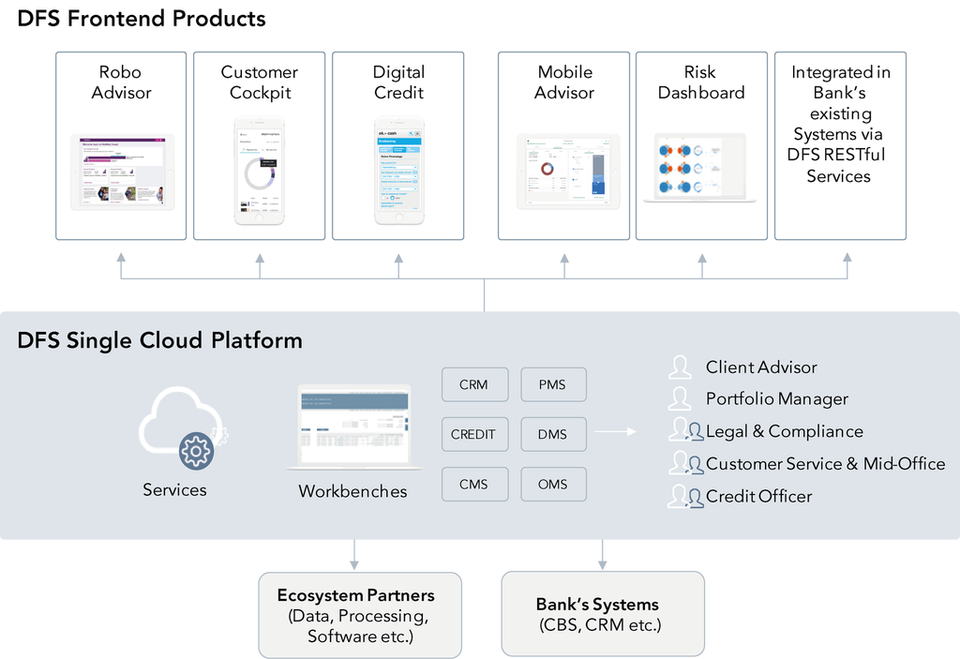

additiv offers modular services which cater to the needs of all client segments in wealth management. The offering is omni-channel, empowering the RM while at the same time offering self-service functionalities.

The additiv Digital Finance Suite (DFS) is a future-proof platform supporting the growth of your business. Once you subscribe to this platform, you gain access to a multitude of use cases for your current and future activities. The corresponding costs are correlated to the growth of your business. The additiv Digital Finance Suite is capable of integrating core banking systems, order management systems, custodians and information data providers into a new platform, which is the foundation for numerous use cases.

additiv DFS enables omni-channel

and automated end-to-end processing

About additiv

additiv was established in 1998 and is a leading provider in the field of digitalization of wealth managers. With offices in Zurich, Singapore and Frankfurt and development centres in Romania, Ukraine and Vietnam customers are served across Europe, Asia and Africa. An ecosystem with a fine selection of renowned and globally operating technology and service providers in Wealth and Credit Management enriches additiv’s offering.