In November 2007 the Markets in Financial Instruments Directive (MiFID) came into effect, with the aim of enhancing consumer protection and increasing competition and choice across investment markets in Europe. Its successor, MiFID II, is now on the horizon. Daniel Judge speaks to key figures about the implications for the industry

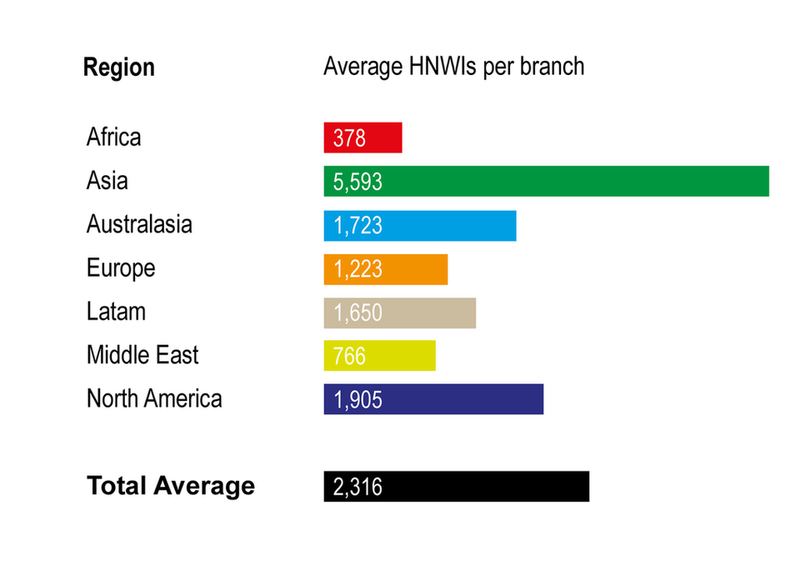

The average number of millionaires or HNWIs per physical branch in Asia stands at 5,593, far exceeding the global average of 2,316 HNWIs. In contrast, the Middle East has just over 767 HNWIs per branch of a private bank or wealth manager.

The data was compiled by Private Banker International using data on the number of HNWIs in cities around the world from WealthInsight. The data was matched against PBI’s own database of wealth managers and private banks.

Opportunities abound in Asia

With the highest number of HNWIs being served by a private bank or wealth manager branch, Asian cities present a potential growth area for firms looking to expand in this region.

While Yokohama in Japan tops the list for the most wealthy being served per branch, China ranks highest at a country level.

Many of China’s tier 2 and 3 cities are rank among the top cities clocking the most HNWIs per branch. Many of these cities have seen a rapid increase in HNWIs over the past few years, leaving private banks and wealth managers struggling to keep pace.

Technology is often touted as a solution to geographical challenges. Online wealth management tools (known as ‘robo-advisors’) have been rolled out by almost every major Asian private bank.

However, recent studies have shown HNWIs – and especially those of increasing wealth – often rather professional advice on their investments. The UK’s largest fintech– Nutmeg – has just announced it is trailing paid-for access to professional financial advisors after Scalable Capital, a rival, announced the same earlier in the year.

This demand for personal financial advice is only likely to increase during periods of economic uncertainty. China looks to be in such a period as its economy sees the lowest growth since the first quarter of 2009.

Such technologies are relatively untested against such volatilities. Wealth managers in the region can therefore expect more enquiries from their clients in the near future.

Average number of HNWIs per private bank/wealth manager branch: Regional Breakdown

Saturated cities in Middle East and Africa

In Middle Eastern and African cities the average number of HNWIs per branch is in the triple figures, way below Asia’s 5593.

Private banks and wealth managers in these regions face an opposite set of issues compared to those in Asia. In the Middle East and Africa there are relatively few cities that HNWIs gravitate towards, meaning national and international financial institutions must compete in the same crowded spaces.

In Lagos, for example, there are 21 such branches, according to the data, which is on par with Monaco.

These cities are not only crowded with players but the growth of their HNWI population has been disappointing. The number of HNWIs in Kuwait City fell 0.1% in the past five years according to WealthInsight’s data. Growth has also been sluggish in South African and Nigerian cities.

Average number of HNWIs per private bank/wealth manager branch: Country Ranking